Weekly Update – 14 March 2022

Further escalation in sanctions over the war in Ukraine put pressure on global share markets last week, with US consumer-related stocks feeling the brunt of the pain last week. This, combined with some higher inflation data and concerns over monetary tightening, saw bond yields rise and UK gilts fall by over 3% on the week. This comes in advance of Central Bank meetings this week in the US (Wednesday) and the UK (Thursday), where we expect to see 0.25% rate hikes from both Banks. This, combined with developments around the war in Ukraine, is the likely focal point for markets as we head into the week.

Last Week

- Global stocks posted losses (driven mainly by the US) but the UK and Continental European markets had a good bounce

- The UK stock market had its best week since January 2021, helped largely by mid-cap stocks

- Commodities continued their rise, with Nickel rising by c65% on the week

- Inflation data continued to come in hot, with US and European numbers both at high levels

- Bond markets sold off, with UK gilts down over 3%

- Gold continued its strong run

This Week

- Developments between Russia and Ukraine are likely to dictate the direction of markets. Added to that, though, there are some key events scheduled.

- Wednesday night sees the Federal Reserve conclude their meeting, where it is highly likely that they will raise rates for the first time since December 2018. The market is priced for a 0.25% rate rise, which would take the upper end of the rate to 0.5%.

- The Bank of England meet on Thursday where it is likely that rates will be raised by 0.25% to 0.75%.

- There’s also a decent amount of economic data this week, with Retail Sales in the US (Wednesday), US housing starts (Thursday) and UK employment data (Tuesday).

- The corporate calendar sees full-year earnings reports from Petrofac and Ferguson (Tuesday), Wickes and Fevertree (Wednesday) and Deliveroo and Cineworld (Thursday).

Last Week’s Highlights

Global stock markets finished down by about 0.5% last week, with some very mixed performance amongst the different regions. Performance was softened by weakness in the Pound, with Sterling down by about 1.5% on the week vs the US Dollar. The US (which constitutes circa 68% of the global index) was the main drag on performance, falling by 2.8% as big technology shares weighed. However, there was a decent bounce from smaller markets such as the UK and Europe ex UK: both up by 3% and 2.7% respectively. In fact, the UK FTSE All Share enjoyed its best week of performance since January last year.

Within the UK market, it was the FTSE 250 that drove gains, rising by 4.3% on the week vs the FTSE 100, which rose by 2.8%. Notable gainers on the week were Evraz (which rose by 52% on the week but remains down 80% on the year), Pearson (+26.4% on the week on news of a bid by Apollo) and M&G (+21.6% on the back of good results which included a share buyback of £500m). At the other end of the scale was B&M Value Retail (-8% on the week), Rio Tinto (-7.7%) and Relx (-6.5%).

On a global basis, the “value” style outperformed “growth” on the week and “small” companies beat “large” ones. As a style, value is now about 12% ahead of growth for the year-to-date. Consumer Staples and Technology were the worst performing sectors last week, with the Tech sector now down nearly 20% for the year. Within Staples, it was names such as Coca-Cola and Pepsi (both down about 6% on the week) along with other food producers that suffered on announcements that they were suspending business in Russia.

Despite oil markets finishing the week down (by c5.5%), they were extremely volatile over the week, with Brent and WTI oil both pushing up towards $130 a barrel earlier in the week, and Brent actually getting as high (intra-day) as $139/barrel, which was a 14-year high. However, the Commodities index still finished the week up 0.9% due in no small part to its nigh on 3% holding in Nickel which rose a staggering 65% on the week (!) due to Russia’s threat to ban nickel exports (Russia exports over 9% of the world’s supply).

It seems that every week there is a new super high inflation print at the moment and last week didn’t disappoint. US CPI inflation came out on Thursday at a level of 7.9% (the most since January 1982). In Italy, Producer Prices (PPI) increased by an eye watering 41.8%, thanks largely to a 115.6% year-over-year increase in energy costs. The persistence of these high inflation numbers has meant that Central Banks have been reticent to soften their stance. This was evident at Thursday’s meeting of the European Central Bank, where they announced that they might end their asset purchase program (APP) earlier than expected (in the 3rd quarter rather than the end of the year). However, the key focus will be on this week’s Federal Reserve meeting in the US. Bond futures markets are now pricing in seven hikes by the Fed this year, so there’ll be a lot of eyes on Chair Jay Powell at the post-meeting press conference for any hints about future trajectory.

Bond markets sold off last week, with UK gilts falling by 3.2%. This takes gilts down about 6.4% for the year to date and was driven by the push higher in 10-year bond yields (with the UK 10-year yield closing out the week at 1.49%). The key reason for the push higher is the anticipation of higher rates, with six rate hikes priced into the UK market this year. Other rate-sensitive areas of the bond markets suffered too, with UK Investment Grade credit down by 2.4% on the week (now down 7% for the year) and US IG credit down by 3% on the week (now down by 9% for the year). High yield markets also suffered (due to a combination of rates and spreads) and we’d note that Global High Yield spreads have now moved up by over 1% so far this year (to c5%, which is the highest since Autumn 2020 and now above the 5-year average) and US high yield spreads have also moved up by 1% this year to 3.94% (also the highest since Autumn 2020 and above the 5-year average). Both of these markets now yield over 6%.

The Chinese authorities held the National People’s Congress last week and announced a goal for growth (GDP) to expand by “about 5.5%”, which was at the higher end of what most analysts and commentators were expecting.

Gold continued its strong run, rising by 2.3% on the week in GBP terms, which takes gains for the year to just shy of 13%. The gold price got within spitting distance of its all-time-high ($2063/oz in August 2020) last week, closing at $2050/oz on Tuesday. It finished the week at $1988.

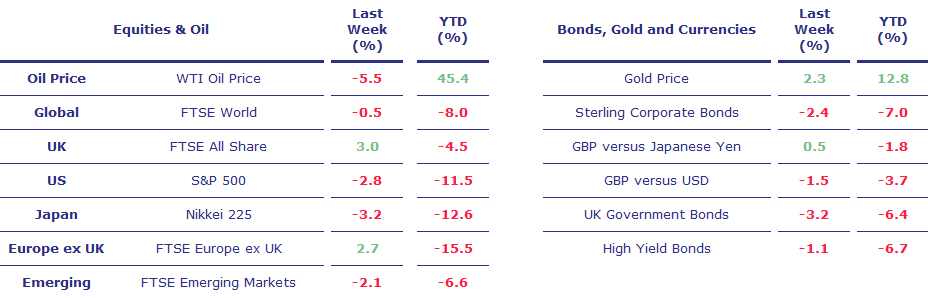

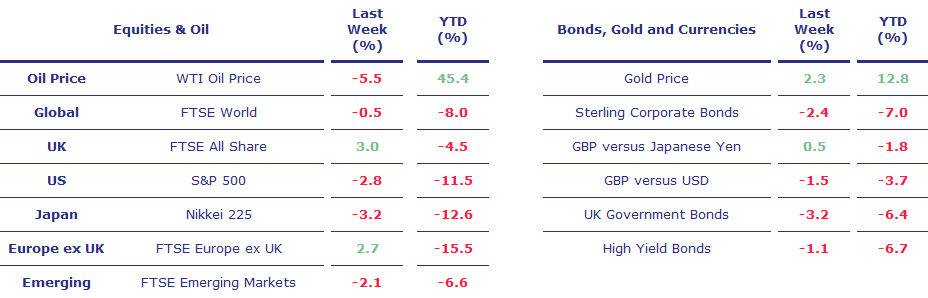

Asset Returns

Equities & Oil: returns are all in base currency, save for Global and Emerging which are in GBP. Bond returns are all shown in GBP. Gold in GBP. Source Bloomberg.

US Inflation (CPI) came in at a rate of 7.9% last week – a fresh 40-year high

Further escalation in sanctions over the war in Ukraine put pressure on global share markets last week, with US consumer-related stocks feeling the brunt of the pain last week. This, combined with some higher inflation data and concerns over monetary tightening, saw bond yields rise and UK gilts fall by over 3% on the week. This comes in advance of Central Bank meetings this week in the US (Wednesday) and the UK (Thursday), where we expect to see 0.25% rate hikes from both Banks. This, combined with developments around the war in Ukraine, is the likely focal point for markets as we head into the week.

Last Week

- Global stocks posted losses (driven mainly by the US) but the UK and Continental European markets had a good bounce

- The UK stock market had its best week since January 2021, helped largely by mid-cap stocks

- Commodities continued their rise, with Nickel rising by c65% on the week

- Inflation data continued to come in hot, with US and European numbers both at high levels

- Bond markets sold off, with UK gilts down over 3%

- Gold continued its strong run

This Week

- Developments between Russia and Ukraine are likely to dictate the direction of markets. Added to that, though, there are some key events scheduled.

- Wednesday night sees the Federal Reserve conclude their meeting, where it is highly likely that they will raise rates for the first time since December 2018. The market is priced for a 0.25% rate rise, which would take the upper end of the rate to 0.5%.

- The Bank of England meet on Thursday where it is likely that rates will be raised by 0.25% to 0.75%.

- There’s also a decent amount of economic data this week, with Retail Sales in the US (Wednesday), US housing starts (Thursday) and UK employment data (Tuesday).

- The corporate calendar sees full-year earnings reports from Petrofac and Ferguson (Tuesday), Wickes and Fevertree (Wednesday) and Deliveroo and Cineworld (Thursday).

Last Week’s Highlights

Global stock markets finished down by about 0.5% last week, with some very mixed performance amongst the different regions. Performance was softened by weakness in the Pound, with Sterling down by about 1.5% on the week vs the US Dollar. The US (which constitutes circa 68% of the global index) was the main drag on performance, falling by 2.8% as big technology shares weighed. However, there was a decent bounce from smaller markets such as the UK and Europe ex UK: both up by 3% and 2.7% respectively. In fact, the UK FTSE All Share enjoyed its best week of performance since January last year.

Within the UK market, it was the FTSE 250 that drove gains, rising by 4.3% on the week vs the FTSE 100, which rose by 2.8%. Notable gainers on the week were Evraz (which rose by 52% on the week but remains down 80% on the year), Pearson (+26.4% on the week on news of a bid by Apollo) and M&G (+21.6% on the back of good results which included a share buyback of £500m). At the other end of the scale was B&M Value Retail (-8% on the week), Rio Tinto (-7.7%) and Relx (-6.5%).

On a global basis, the “value” style outperformed “growth” on the week and “small” companies beat “large” ones. As a style, value is now about 12% ahead of growth for the year-to-date. Consumer Staples and Technology were the worst performing sectors last week, with the Tech sector now down nearly 20% for the year. Within Staples, it was names such as Coca-Cola and Pepsi (both down about 6% on the week) along with other food producers that suffered on announcements that they were suspending business in Russia.

Despite oil markets finishing the week down (by c5.5%), they were extremely volatile over the week, with Brent and WTI oil both pushing up towards $130 a barrel earlier in the week, and Brent actually getting as high (intra-day) as $139/barrel, which was a 14-year high. However, the Commodities index still finished the week up 0.9% due in no small part to its nigh on 3% holding in Nickel which rose a staggering 65% on the week (!) due to Russia’s threat to ban nickel exports (Russia exports over 9% of the world’s supply).

It seems that every week there is a new super high inflation print at the moment and last week didn’t disappoint. US CPI inflation came out on Thursday at a level of 7.9% (the most since January 1982). In Italy, Producer Prices (PPI) increased by an eye watering 41.8%, thanks largely to a 115.6% year-over-year increase in energy costs. The persistence of these high inflation numbers has meant that Central Banks have been reticent to soften their stance. This was evident at Thursday’s meeting of the European Central Bank, where they announced that they might end their asset purchase program (APP) earlier than expected (in the 3rd quarter rather than the end of the year). However, the key focus will be on this week’s Federal Reserve meeting in the US. Bond futures markets are now pricing in seven hikes by the Fed this year, so there’ll be a lot of eyes on Chair Jay Powell at the post-meeting press conference for any hints about future trajectory.

Bond markets sold off last week, with UK gilts falling by 3.2%. This takes gilts down about 6.4% for the year to date and was driven by the push higher in 10-year bond yields (with the UK 10-year yield closing out the week at 1.49%). The key reason for the push higher is the anticipation of higher rates, with six rate hikes priced into the UK market this year. Other rate-sensitive areas of the bond markets suffered too, with UK Investment Grade credit down by 2.4% on the week (now down 7% for the year) and US IG credit down by 3% on the week (now down by 9% for the year). High yield markets also suffered (due to a combination of rates and spreads) and we’d note that Global High Yield spreads have now moved up by over 1% so far this year (to c5%, which is the highest since Autumn 2020 and now above the 5-year average) and US high yield spreads have also moved up by 1% this year to 3.94% (also the highest since Autumn 2020 and above the 5-year average). Both of these markets now yield over 6%.

The Chinese authorities held the National People’s Congress last week and announced a goal for growth (GDP) to expand by “about 5.5%”, which was at the higher end of what most analysts and commentators were expecting.

Gold continued its strong run, rising by 2.3% on the week in GBP terms, which takes gains for the year to just shy of 13%. The gold price got within spitting distance of its all-time-high ($2063/oz in August 2020) last week, closing at $2050/oz on Tuesday. It finished the week at $1988.

Asset Returns

Equities & Oil: returns are all in base currency, save for Global and Emerging which are in GBP. Bond returns are all shown in GBP. Gold in GBP. Source Bloomberg.

US Inflation (CPI) came in at a rate of 7.9% last week – a fresh 40-year high.