Weekly Update – 12 December 2022

Financial markets paused last week, fearing that monetary tightening will continue and that the world economy will enter a recession next year.

While several better-than-expected US statistics (unemployment and ISM services) already raised doubts that the Fed would slow the pace of rate hikes, the new rise in the producer price index reinforces these worries and raise further questions. This week should therefore be decisive, with the Fed and ECB decisions on rates.

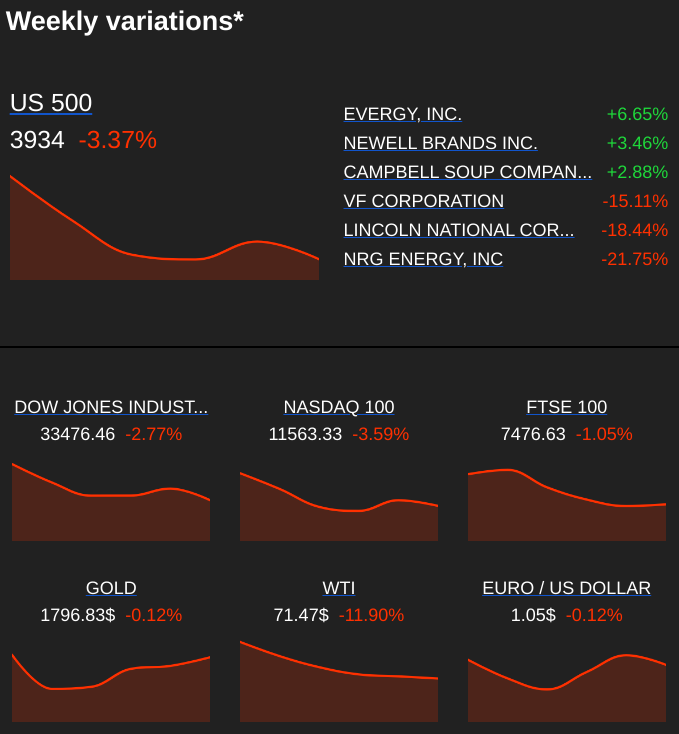

Last week’s gainers and losers

Gainers:

Didi Global: The company, which is often portrayed as a Chinese Uber, soared after the relaxation of Covid restrictions in China, which should lead to a recovery in travel. (+45.5%)

U.S. database platform MongoDB jumped last week after reporting better-than-expected quarterly revenue and raising its full-year revenue guidance. (+21.4%)

A U.S. court ruled in favor of Sanofi, GSK and Pfizer in the Zantac litigation. Haleon, as a former subsidiary of GSK, was indirectly concerned. The British pharmaceutical group was up 9.6% last week.

Ferguson (+9.66%): The distributor of plumbing and heating products to professional contractors gained after posting sales growth of 16.6% with 12.7% organic growth on top of strong prior year comparables.

Losers:

Electricity producer and distributor NRG Energy plunged. The market remains skeptical about its acquisition of Vivint Smart Home, the smart home specialist, for $5.2 billion, which is considered expensive. (-22%).

Lucid Group (-18.97%) The manufacturer of luxury electric vehicles is down after it said that its order backlog declined in the September quarter.

Lululemon Athletica (-14.82%): Lululemon Athletica released its fourth quarter earnings guidance on Thursday. For the holiday season, revenue and earnings are expected to fall short of analysts’ estimates.

VF Corporation, the owner of several well-known brands such as Vans, Timberland, North Face and Eastpak, has warned that demand will be weaker than expected at the end of the year, forcing it to reduce its forecasts. (-13.7%).

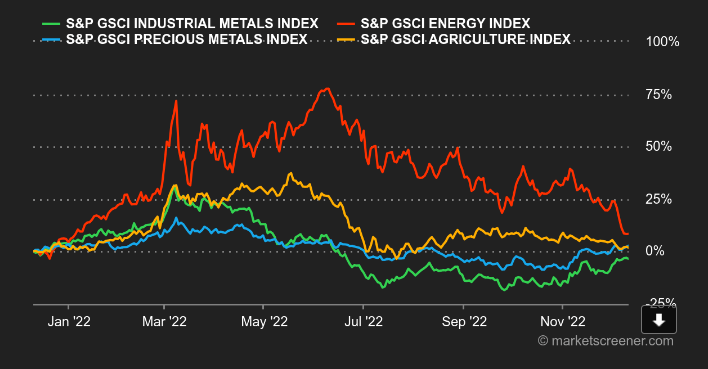

Commodities

Energy: Despite multiple announcements from Beijing, which is trying to revive its economy, fears of recession prevailed last week. This weighed on oil prices, since a deterioration in economic activity is necessarily accompanied by a contraction in oil demand. As a result, Brent crude is trading below the USD 80 mark, while the US benchmark is slowly but surely sinking towards the USD 70 mark. this is the price level that corresponds to the White House’s range for ordering a replenishment of domestic stocks, which have melted like snow in the sun this year.

Metals: In the base metals space, all roads lead to Beijing. In other words, when the Middle Kingdom is doing better, so are metal prices. In this context, the easing of the national health policy as well as the new support measures for Chinese real estate have boosted the prices of the various metals on the LME. Copper is trading above USD 8,500 per metric ton, nickel is up to USD 31,000 and zinc is accelerating to USD 3,240. In precious metals, gold is holding near its recent highs at USD 1796.

Agricultural products: Despite a drop in the dollar, grain prices were little changed last week in Chicago. Wheat is trading around 740 cents a bushel, compared to 644 cents for corn.

Macroeconomics

Atmosphere: Recession is Coming. Recent certainties were too fragile. They did not stand up to contradictory economic signals. The bond market is telling the equity markets that the recession is on its way and that it will be difficult to resist. But the mind of investors is still torn between the fear of a lasting economic slump and the hope that central banks will abandon their punitive policies to avoid damaging growth too much. At the same time, China seems to have finally made a 180-degree turn to revive the country’s flagging economy. The authorities are burying the zero-covid policy and supporting the real estate sector. Investors are holding on to this branch a bit as they await a series of monetary policy decisions in Europe and the US this week.

Rates: Despite a disappointing statistic at the end of the week, the PPI (Producer Prices Index) for November was up by +0.3% compared to the previous month against +0.2% expected, expectations of a rate hike of 50 basis points remained almost unchanged at about 75%. However, we will be watching the release of the CPI (Consumer Price Index) on Tuesday, which is expected to decline slightly to +7.3% year-on-year from +7.7% in October. A better than expected reading will certainly be misinterpreted by investors, while a figure in line with or below expectations should boost the ongoing rally in stock market indices. For now, the U.S. 10-year yield is at 3.53% vs. 3.49% last Friday.

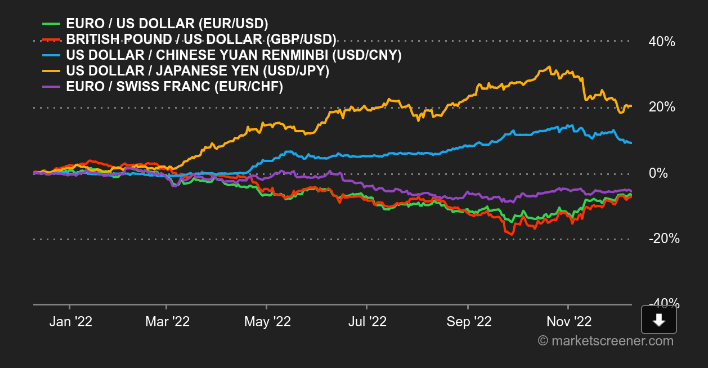

Currencies: The dollar lost ground against the euro last week, around 1.0534 USD to 1 EUR. The market thought it had a guideline on monetary policy, but nothing is simple this year. Friday’s release of higher than expected US producer prices once again cast doubt on whether the Fed will really slow the pace of monetary tightening. Elsewhere, China’s easing of health restrictions is helping to keep the USD/CNY pair below CNY7 per USD. The euro lost some ground against the Swiss franc to CHF 0.9844. The MUFG currency volatility indicator is falling back to its long-term average, after a recent turbulent period.

Crypto-currencies: Uncertainty is leading the way in bitcoin this week. Staying steady around $17,000 since Monday, the digital currency gained +0.26% on Friday. Tiny amplitudes that indicate that crypto-investors do not know what to do after the shockwave caused by the fall of FTX. Without strong positive catalysts, bitcoin, and the cryptocurrency market as a whole, may have a hard time making a definitive recovery from the steep decline it has experienced in recent months.

Agenda: It’s getting crowded at the gate this week. Four major central banks are on deck with monetary policy decisions: the Fed on Wednesday, then the Swiss National Bank, the Bank of England and the European Central Bank on Thursday. But that’s not all! We can add to this the German ZEW index and the US inflation for November (Tuesday), the British inflation for November (Wednesday), the US retail sales for November (Thursday) or the flash PMI indices of the major economies in December (Friday). All of which will provide plenty to do before the holiday break.

Waiting for Jay

All eyes are now on China, the last defense against a recession that seems imminent in the West. The 9% drop in China’s annual export growth in November, as well as revolts against the zero-covid policy, have pushed the Chinese government to reopen its economy. Meanwhile, last week’s better-than-expected PPI has investors questioning the Fed’s policy. Could Fed Chairman Jerome Powell announce a 75-basis point rate hike, instead of the 50-basis points initially expected this week? Everything remains possible. However, the inflation scenario seems to be gradually giving way to a recession scenario as we enter 2023.