Weekly Update – 26 December 2022

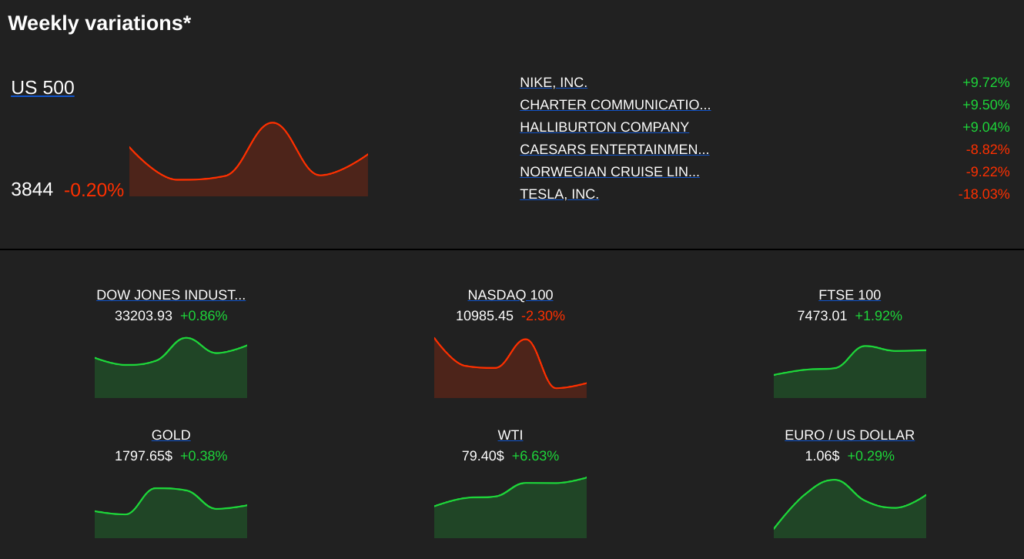

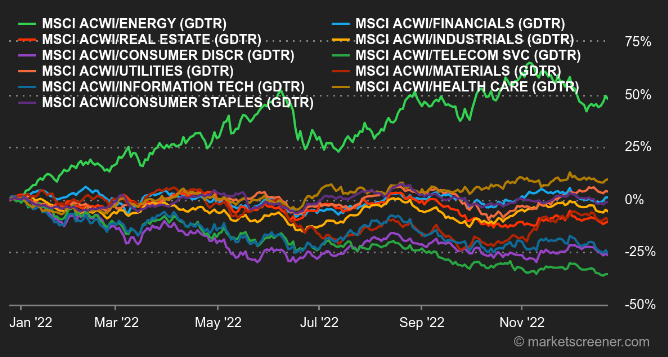

Fears of further monetary tightening across the Atlantic, following good US statistics, and the risks of recession in Europe, weighed on the trend during this weekly sequence, as the end-of-year holidays approach. While Europe ended in disarray, Wall Street is still losing ground in the absence of many operators. Volatility could continue during the holiday season.

This week’s gainers and losers

Gainers:

TAL Education (+35%): The company specializing in education services in China is benefiting from the return of distance learning in the country, after the expansion of the pandemic following the end of the zero-covid policy.

Cleveland-Cliffs (+12%): The steelmaker announced that it would raise its prices from the beginning of the year, as most fixed-price contract volumes have already been renewed.

Nike (+10%): The company’s shareholders received strong quarterly results as a Christmas present, reassuring the market that the group’s year-end performance will be good.

Commerzbank (+9%): Central banks are tightening the screws as the year ends, with expectations of more restrictive policies. This will benefit financial institutions, which are rebuilding their margins when rates are high.

Losers:

Tesla (-16%): Elon Musk’s Twitter antics continue to scare investors. To make matters worse, the brand has announced rebates in the United States on some models to revive a struggling sales momentum.

BlackBerry (-18%): The Canadian’s results fell short of expectations in the most recent quarter, particularly in its cybersecurity division.

Aston Martin (-14%): The automotive sector as a whole suffered from recession fears. Fragile players like the British group more than others. The stock had recovered until this week from the lows signed earlier in the fall.

Aroundtown (-11%): The rise in interest rates is taking its toll on European real estate companies. The German company also suffered a downgrade of Berenberg’s recommendation from buy to hold, with a target reduced to EUR 3.

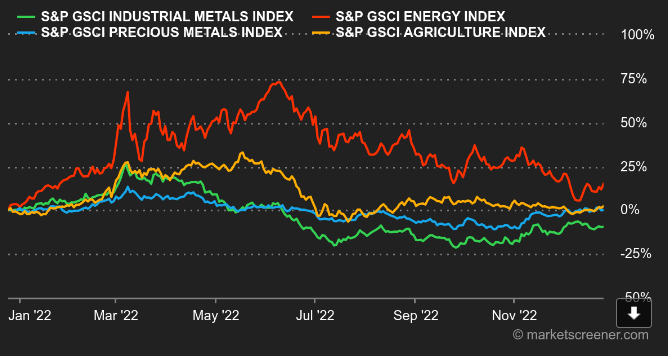

Commodities

Energy: Oil prices continue to rise for the second week in a row. With a recovery in China, the disruption of a portion of the Keystone pipeline in the United States and a surprise drop in U.S. inventories, the planets seem to be aligning in favor of black gold. Traders are also keeping an eye on Russian oil exports, which have tended to slow down since the European embargo came into effect, which currently only affects exports by sea. North Sea Brent is trading around USD 83 while US WTI is trading at USD 79.4 per barrel. In Europe, natural gas prices continue to fall to EUR 85/MWh, well below the ceiling set by European energy ministers, who agreed on a threshold of EUR 180/MWh.

Metals: Beijing wants to introduce new measures to stimulate its economy next year. This statement by Chinese officials supported base metal prices this week. Copper is trading around USD 8350 per metric ton. Lead also registered a weekly bullish streak, at USD 2,280, its highest level since June. In precious metals, gold is trading around the USD 1,800 line.

Agricultural products: Winter is coming. Freezing temperatures are affecting the central and eastern United States, with a combination of snowfall, freezing winds and freezing rain. Not exactly ideal conditions for crops, whose prices have climbed in Chicago. Wheat is trading at 770 cents per bushel, compared to 665 cents for corn.

Macroeconomics

Atmosphere: Not great. U.S. economic statistics continue to blow hot and cold and are causing investors to lose their minds. Rate hikes have slowed inflation and are beginning to weigh on industry and real estate, but consumption is holding up and the job market is not weakening. To be more comfortable, and thus moderate its monetary tightening policy, the central bank would need a more generalized slowdown. It is therefore maintaining its hawkish stance. The same is true in Europe, where the ECB is also having to look the other way, despite the energy crisis that is spreading through the industry.

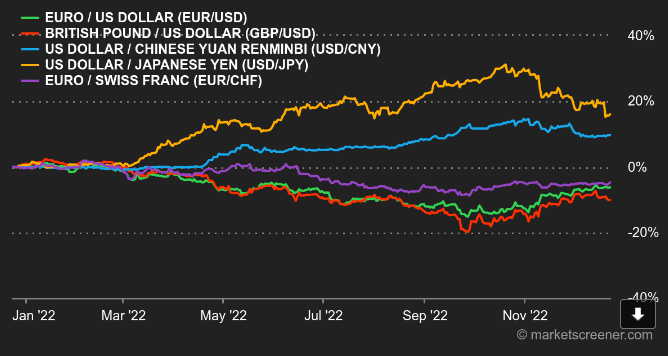

Currencies: There are two major moves in the foreign exchange market this week. On the one hand, the ruble has suffered, with declines of more than 5% against the euro, the dollar and the British pound. The Russian currency is affected by fears about the impact of an oil embargo and a cap on hydrocarbon prices. On the other hand, the yen strengthened against the major currencies after the Bank of Japan unexpectedly decided to ease its policy of controlling the yield curve. The market saw this as a sign that the Bank of Japan will abandon its accommodative policy. It was JPY 132.60 to the USD and JPY 140.80 to the EUR on Friday.

Rates: For rates traders, it’s a bit of an early Christmas. Bonds continue to tighten on the back of the latest macroeconomic releases in a still hawkish environment from central banks. The U.S. 10-year is rebounding from its support at 3.38/3.35% thanks to a small bullish double-dip formation and is now approaching its 50-day moving average, resistance around 3.80/3.90%, the last stronghold before the previous highs at 4.30%. The German 10-year is a little ahead of schedule, as it is only a few steps away from its October peak at 2.55%, without showing many signs of losing steam for the time being. As for the Europe/US spread, it is almost unchanged at 134 points. We will keep in mind that a continuation of tightening remains our central scenario for the coming weeks/months.

Crypto-currencies: Bitcoin remains in equilibrium this week, posting a very slight +0.68% and therefore still hovering around $17,000 at the time of writing. Since Christmas 2021, in the space of a year, bitcoin has shed 66% of its valuation, going from $52,000 to $17,000. Fractions of bitcoins as a gift last year will not have been the best idea. Without strong positive catalysts, bitcoin, and the cryptocurrency market as a whole, may struggle to regain the hearts and confidence of investors.

Calendar: The calendar is pretty sparse between Christmas and New Year’s Day. There will still be a few second-tier indicators in the US, as well as the traditional weekly jobless claims (Thursday) and the Chicago PMI (Friday). Still, watch out for the market’s sometimes brutal reactions lately.

Investors are exiting equities in droves

This week, stock markets continued to fall in the wake of last week’s recession. We will surely have to wait for confirmation that inflation is slowing down before central banks start to change their tune and gradually stabilize the increase in key rates. This is what has scared the market since the end of inflation does not mean the end of monetary tightening, at least not immediately. In fact, we have seen massive outflows in the equity market of over $40 billion, the highest level ever. The selling pressure is there, but for how long?