Weekly Update – 25 April 2022

Last week was shaped by hawkish talk from Central Bankers (around controlling inflation) and a high-profile subscriber miss from Netflix. This saw both bonds and stock markets sell-off, with the US being the biggest drag on the global index. Losses were tempered to some degree by the weakness in the Pound, particularly vs the US Dollar, with the Dollar strengthening on the expectation of much higher rates. This week sees us enter “blackout period” for the Federal Reserve ahead of their meeting on 4th May, but it remains action-packed for markets. There’s a whole host of economic data to focus on and a heavy week of corporate reporting too, with the big tech companies in the US being the highlight.

Last Week

- Stock markets fell as Central Bankers talked tough

- The US Dollar strengthened as over 9.5 further rate hikes are now being priced in for this year

- The US and Chinese share markets were amongst the worst performers

- Bond markets were under pressure

- UK economic data showed some cracks in the Consumer, with retail sales data coming in weak

This Week

- It’s a busy week on both the economic and corporate calendar.

- On the economic front, we’ve got US House Price sales on Tuesday, Industrial Profits from China on Wednesday, Japanese retail sales as well as the Bank of Japan meeting on Thursday and Chinese Manufacturing PMI on Friday, along with Eurozone Inflation data (CPI).

- Corporate earnings are also thick and fast this week, with 179 of the S&P 500 companies reporting. Tuesday sees Q1 earnings from HSBC, UBS, Alphabet and Microsoft. Wednesday kicks off with earnings from Lloyds Bank and Deutsche Bank as well as Ford Motor, Boeing and Meta Platforms. Thursday then sees earnings from Barclays, Sainsbury’s, Amazon, Apple, Intel and Twitter, and Friday sees earnings from AstraZeneca, Natwest and ExxonMobil.

Last Week’s Highlights

Global stock markets fell by about 0.8% last week, dragged lower by a combination of hawkish talk from Central Banks, weak economic data and some high-profile earnings misses. This risk off tone saw the US Dollar rise by about 1.7% vs the British Pound, which actually softened the impact of the overseas losses. This saw the Pound trade as low as 1.27 vs the US Dollar, which is the weakest it has been since September 2020.

The US stock market was off by about 2.7% (pulled down by the technology and the consumer sector), and Emerging Markets also lagged over the week: down 1.9%, with China being the main drag on the market here (down over 4% on the week as the zero-tolerance policy towards COVID continues to thwart growth).

The UK FTSE All Share was down by 1.14% on the week, with fairly similar performance across the FTSE 100 (large cap) and the FTSE 250 (generally smaller and more domestic-focused). The Basic Materials sector weighed most heavily on the FTSE 100 index, with Anglo American down 16.6% on the week, having reported production numbers that missed estimates as well as citing cost inflation pressures in the supply chain. Despite this fall, Anglo still remains up 18.7% for the year-to-date. Antofagasta and Glencore joined Anglo at the bottom of the table for the week in the FTSE 100, down by 10.4% and 10.2% respectively. More classic defensive names performed best last week, with Smith & Nephew up by 8.2%, Smurfit Kappa up by 7.8% and Royal Mail up by 7.3%.

US earnings season is now fully underway and remains very much a mixed bag. 20% of companies in the S&P 500 have now reported, with 79% beating estimates (slightly above the 5-year average), with a blended earnings growth rate of 6.6% for the first quarter. Analysts are still expecting a growth rate of c10% for this calendar year. For the season so far, we’ve seen strong earnings from the energy and materials sectors, the banks were generally strong, although gains from rising interest rates were generally offset by increased provisioning for reserves (in the event of a slowdown), and we also had a big subscriber miss from Netflix, which added to the unsettled tone within the market. Netflix fell 36.8% last week as it reported a loss of 200,000 subscribers in the first quarter (having guided to growth of 2.5m). The bear case issues of having an estimated 100m households (of the 221.6m subscribers worldwide) that are watching via shared passwords, combined with consumers moving away from the “stay-at-home” stocks, weighed heavy.

The bond markets were again under pressure last week, with UK gilts falling by 0.2% and US Treasuries falling by 0.6%. This takes losses for the year for the UK gilt market to 9.85% and 8.1% for US Treasuries. Yields rose on the week, with 10-year yields closing out the week at 1.96% in the UK and at 2.899% in the US. This move higher in yields came on the back of hawkish talk from key policymakers in the US. James Bullard (President of the Federal Reserve Bank of St Louis) suggested that they should move “expeditiously”, indicating a rate move of 0.75% at the next meeting could be on the cards, and Fed Chair Powell said a 0.5% rise could be on the table at the 4th May meeting. This led to a repricing higher of rate hikes and there are now 9.5 further hikes priced in by the markets this year. The UK pricing is less severe, but has also increased recently, with 6.5 further hikes being priced in for this year – which would see year end base rates between 2.25% and 2.5%.

It wasn’t a great week for UK data. Following the 7% CPI number that we got just before Easter (the highest in 30 years), Retail Sales came out on Friday and were generally disappointing, falling by 1.4% vs estimates of a 0.3% fall (month on month), and business survey data (PMIs) also came in lower than expected – although still in expansionary territory.

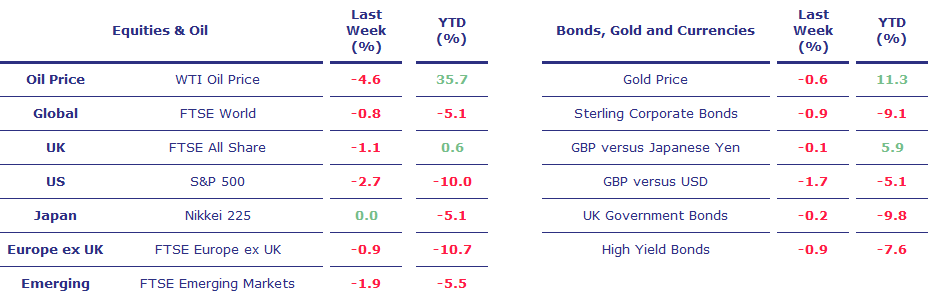

Asset Returns

Equities & Oil: returns are all in base currency, save for Global and Emerging which are in GBP. Bond returns are all shown in GBP. Gold in GBP. Source Bloomberg.

A bad week for the Pound, with Sterling falling to its lowest level since September 2020 vs the US Dollar