Weekly Update – 4 April 2022

Equity markets had a decent rise last week, boosted by reports over a possible ceasefire in the Russia / Ukraine war and also on news of record share buybacks by US companies. This helped repair some of the damage to the global share market in the first quarter of this year, with the index finishing down 1.9% for Q1 having been down over 11% in early March. Bond markets also bounced last week as yields fell, but that didn’t stop them from having their worst quarter since 1980; Friday also saw a key measure of the US yield curve invert for the first time since summer 2019. This week is very light indeed in terms of scheduled economic and corporate data, with the Q1 earnings season kicking off next week.

Last Week

- Global stock markets rose for the 3rd consecutive week running but finished the quarter in negative territory

- The UK stock market was the best performer amongst the majors in the first quarter

- Emerging market shares bounced strongly last week, helped by Brazilian and India stocks

- Bond markets had a decent week, but sovereign bonds had a miserable quarter, with US Treasuries having their worst quarter since Q3 1980

- The US yield curve (2s10s) finished the week inverted as US jobs data showed the unemployment rate dropping to 3.6%

- Commodities gave up some ground last week, but the Bloomberg Commodity index still enjoyed its best quarter since records began just over 30 years ago

This Week

- Scheduled data is fairly thin on the ground this week.

- Chinese Caixin Services PMI numbers on Wednesday will be closely watched following recent weakness in Manufacturing data and also given the recent COVID-related shutdowns we’ve seen in key economic districts.

- Wednesday sees the release of UK PMI data (S&P Global) which is expected to remain strongly in expansionary territory. Thursday then sees house price data released from Halifax.

- The minutes from the last FOMC meeting in the US are released on Wednesday and jobless claims data on Thursday. Friday sees the release of the Baker Hughes oil rig count data.

- It’s also very quiet on the corporate front, with full year earnings from Hilton Food Group, a H1 trading statement from Topps Tiles on Wednesday and Q1 earnings from Levi Strauss also on Wednesday.

Last Week’s Highlights

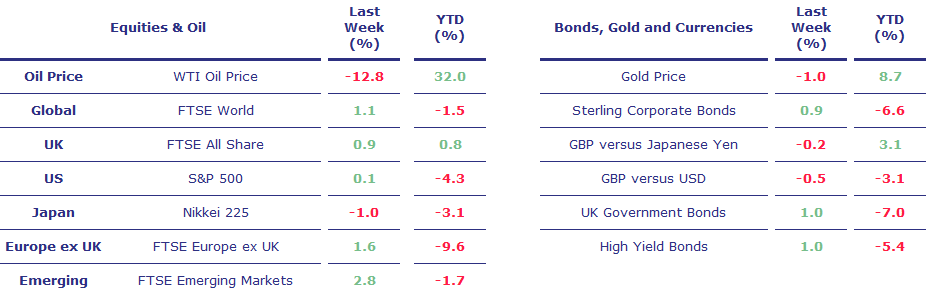

Global stock markets rose by about 1% last week, helped by decent returns from markets such as the UK and Europe. There was also weakness in the Pound, with Sterling falling by about 0.5% vs the US Dollar on the week. This takes losses for the year in global stocks to “just” 1.5%, with the global index of stocks falling by 1.9% in the first quarter. For the quarter, the UK was the best performing market (with the All Share up by 0.5%); this was very much driven by the larger shares in the index, with the FTSE 100 up by 2.9% in Q1 and the energy sector up by circa 25%. Continental European markets were the worst performing amongst the majors in the first quarter, with the broad index down by 10.1% in Q1, although it did have a decent week just gone, bouncing by 1.6%.

Emerging market equities were the best performing last week, rising by 2.8%, with Brazilian and Indian share markets both rising by over 4%. Brazilian shares have been one of the bright spots of the year so far and although just a circa 6% weight in the Emerging markets index, they have contributed a good deal of gains given that they are up roughly 40% this year. Much of this rise owes to the fact that they have roughly 40% of the index weighted towards energy and materials, with just over 20% in financials: sectors which have all benefitted from the inflationary environment of this year.

Within the UK market, the FTSE 250 outperformed last week, up by 1.3%, which was nearly double the return of the FTSE 100. The FTSE 100 index remains comfortably the better performer for the year though, with the index up by 3.2% vs the FTSE 250 which is down by 9.2% to Friday’s close. For the first quarter, Glencore has been the best performer in the 100 (up by 33.4%), closely followed by Anglo American (+31.7%) and BAE Systems (+30.5), with big oil companies and other miners not far behind. The laggers in the first quarter were the consumer names, with Coca Cola the worst performer in the 100 index (-37.4%), followed by Royal Mail (-34.98%) and JD Sports (-31.93%).

Bond markets had a decent week, but still finished the first quarter in deep negative territory. UK gilts rose by about 1% last week, with US Treasuries rising by about 0.55%. This made for 1st quarter losses of about 7.2% in the UK gilt market and about 5.6% in the US Treasury market. This made for the worst quarter for US Sovereign bond markets since 1980. Sterling corporate bonds rose by 0.9% last week, but still finished the first quarter down by 6.6%, whilst high yield markets rose by 1% last week, but still finished the first quarter down by 5.25%.

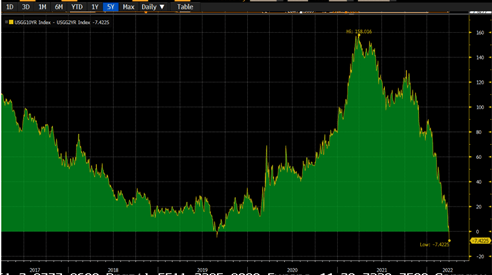

The US yield curve remains one of the most closely watched measures currently in financial markets (not least because of its ability to predict recessions) and it inverted last week following strong jobs data on Friday. US 10-year Treasury yields closed out the week with a yield of 2.38%, whilst US 2-year yields closed out the week yielding 2.45%, making for an “inversion” of 7 basis points. This is the first time that the curve has closed inverted since August 2019. A negative yield curve has very good predictive powers as a leading indicator for recession, but we’d note that it is more reliable when it inverts for at least a month and also when other key parts of the curve invert; we’re not there yet but it’s closely poised.

The US jobs data on Friday saw unemployment drop a bit more than expected, to a rate of 3.6%. This is very close to the pre-pandemic low of 3.5% that it reached in September 2019. 431,000 new jobs were shown to have been created in March, which was a little below the number expected (490,000) but the prior month’s numbers were revised upwards. This served to strengthen expectations for rate hikes, with 8.6 further rate hikes now being priced in by US markets by the end of this year.

Inflation was once again front and centre last week. Eurozone inflation came in at 7.5% in March (a record high) and US PCE came in at 5.4% (the highest level in nearly 40 years).

Commodity markets gave up a bit of ground last week, with the Bloomberg Commodity index dropping by 4%. This was largely due to the near 13% fall in the oil price which came on the back of a record release of about 180 million barrels of oil from the US stockpile. This planned release will take the US Strategic Petroleum Reserve down to its lowest level since 1984. Despite the pull-back last week, oil markets remain well up for the year and the broad Commodities index is up close to 30% YTD.

Asset Returns

Equities & Oil: returns are all in base currency, save for Global and Emerging which are in GBP. Bond returns are all shown in GBP. Gold in GBP. Source Bloomberg.

The US yield curve (2s10s) inverted last week for the first time since August 2019