Weekly Update – 11 April 2022

Global stock markets gave up some ground last week, on the back of hawkish comments from Central Banks and higher bond yields. This weighed on growth stocks and markets such as the US and Japan. UK stock markets continued to out-perform, with the FTSE 100 driving gains. The main casualties for the week were in the bond markets, with UK and US Sovereign markets both down over 1.5% as yields rose on the back of higher interest rate and inflation expectations. Commodity markets were once again the star performers and the beneficiaries of the supply squeezes we’re seeing globally, but particularly from Russia and Ukraine. Although shortened for Easter, this is a fairly packed week, with some key economic data as well as several of the big banks in the US reporting their Q1 earnings numbers.

Last Week

- Global stock markets fell, with the US and Japanese markets lagging

- UK stocks performed well, with larger names in the index doing best

- Bond yields rose significantly in both the US and the UK, driven by better economic data but also by hawkish comments from Central Bankers (signalling higher interest rates)

- Bond markets suffered fairly heavy losses on the week (driven by rising yields)

- Commodity markets continued to perform well, with food and energy driving the gains

This Week

- It’s quite a heavy week of economic data. In the UK we have jobs data tomorrow (the unemployment rate is expected to tick down to 3.8%) and inflation data on Wednesday morning, with CPI expected to move up to 6.7% and RPI to 8.8%.

- The US have their CPI numbers due out tomorrow (expected to rise to 8.4%) and retail sales data due out on Thursday. Thursday also sees the European Central Bank meeting.

- There’s also a fair bit on the corporate side, with the first quarter earnings season kicking off in the US. Wednesday sees Tesco report full year earnings, and JP Morgan kick off Q1 earnings for the banks in the US, with Morgan Stanley, Citigroup, Goldman Sachs and Wells Fargo all following on Thursday.

Last Week’s Highlights

Global stock markets sold off last week, with the global index falling by 0.95%. The fall was driven largely by US and Japanese markets, which fell by 1.2% and 2.5% on the week respectively. US markets struggled early on in the week following some hawkish comments from Federal Reserve members and also the release of their recent March meeting minutes which pointed towards accelerated tightening. The hawkish comments came from Fed Governor Brainard, who has historically leaned towards the side of accommodation (and hence marked a major change in tone), whilst the minutes revealed that policymakers were prepared to reduce the balance sheet by $95 billion per month as opposed to the consensus expectation of around $80 billion.

From a sector perspective, healthcare (+3.4%), energy (+2%) and utilities (+1.8%) performed best, whilst technology (-4.3%) and consumer discretionary (-3.5%) lagged. Big names in the US index came under pressure last week, with Nvidia dropping by 13.5%, Amazon falling by 5%, Salesforce by 6% and Microsoft by 3.5%. Twitter was the best performing stock in the US index last week, rising by 17.6% following news that Elon Musk had acquired a 9.2% stake in the company.

UK stocks were once again the best performing part of the global stock market, with the FTSE All Share rising by 1.5% on the week which takes its gains for the year to 2.3%. The FTSE 100 was again the strongest part of the UK market, up by 1.9% on the week, with the FTSE 250 remaining flat for the week. For the year-to-date, the FTSE 100 is up by 5.1%, whilst the FTSE 250 is down by 9%. Within the 100 index, AstraZeneca, GlaxoSmithKline and Berkeley Group were the best performing stocks, returning 8.5%, 7.4% and 6.6% on the week respectively. Smurfit Kappa and Intermediate Capital Group were the worst performers on the week, returning -10% and -7.5% respectively.

Better economic data combined with the hawkish comments and minutes from the Federal Reserve to push bond yields higher on the week. Although economic data was very thin on the ground last week, the data point of note concerned the US jobs market, which showed that weekly jobless claims had fallen to their lowest level since 1968, with just 166,000 individuals making new claims for unemployment. This saw further rate hikes be priced into US bond markets (8.7 further hikes are now priced in for this year) and the yield curve steepen. The US 10-year yield closed the week at 2.7% which is its highest level in three years, whilst 10-year UK Gilts closed at their highest yield in just over six years. Although this made for quite hefty negative returns for US Treasury bonds, it did have the impact of steepening the US yield curve (which closed inverted last week), which ended the week with 19 basis points of difference between 2-year and 10-year Treasury bonds.

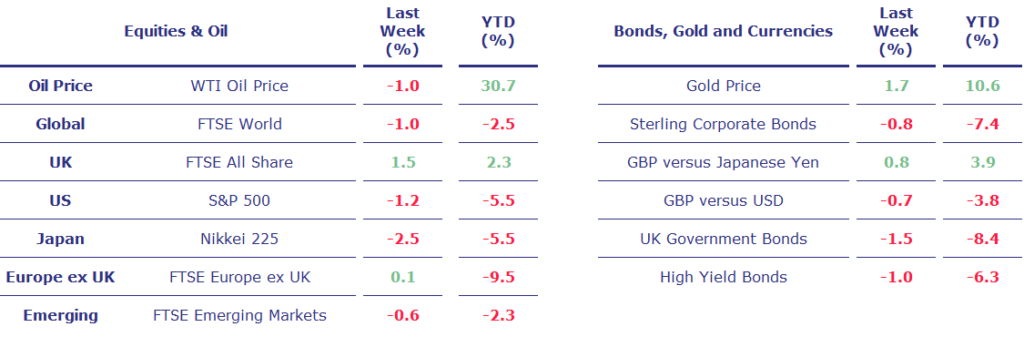

Bond returns were fairly miserable last week, with UK government bonds using 1.5%, US Treasuries losing 1.7% and US investment grade bonds losing 3.2%. UK Gilts are now down by 8.4% for the year-to-date, with US Treasuries down by 7.4%, US Investment Grade down by 11.2% and Global high yield markets down by 6.3%.

Commodity markets were once again the star performers last week, with the Bloomberg Commodity index rising by 2.6% which takes its gains for the year to 32.5%. As has been the case since Russia’s invasion of Ukraine, it was food and energy elements of the commodity index that drove gains, with Natural Gas rising by 9.7% on the week and Wheat rising by 9.3% on the week.

Asset Returns

Equities & Oil: returns are all in base currency, save for Global and Emerging which are in GBP. Bond returns are all shown in GBP. Gold in GBP. Source Bloomberg.

A bad week for bond markets as the UK 10-year yield rose to its highest level since January 2016