Weekly Update – 21 November 2022

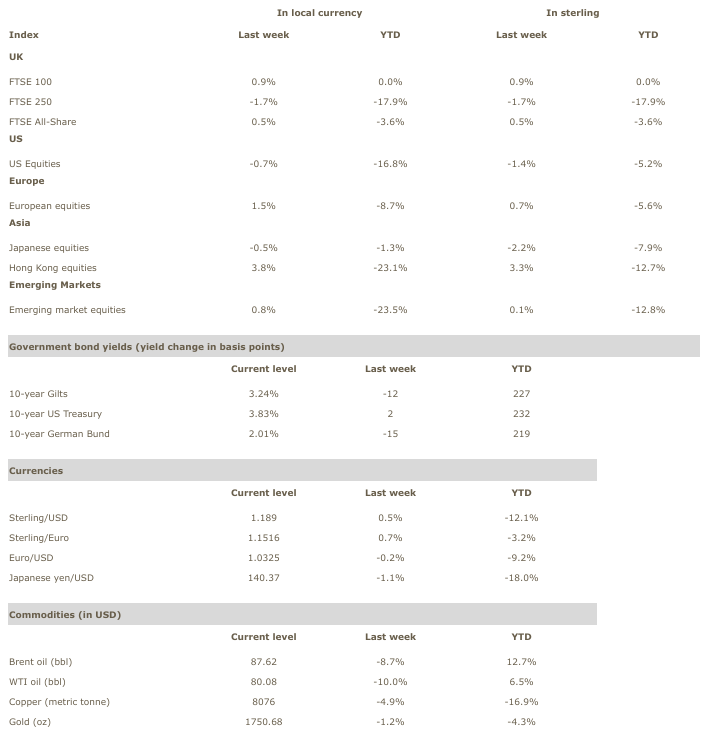

| Markets last week |

| The positive mood in risk appetite generally continued last week, with the US producer price index (PPI) confirming the trend of lower inflation hot on the heels of the previous week’s falling consumer price index (CPI). Against a backdrop of mixed economic data, with still strong employment and consumer spending in the US, weaker Chinese growth numbers and mixed economic surveys globally, the UK was in the limelight for the highest consumer inflation in 41 years and wages rising at the highest rate in 20 years. The main market-moving item, though, was the UK budget, where the Chancellor delivered bad news and yet the investment result was limited, at least for the time being, given that the message, if not the details, had been widely anticipated. Despite constant talk of an upcoming US recession, growth is still solid, with the Atlanta Federal Reserve’s estimate for Q4 GDP at 4.4%, up from 4.0% the previous week, driven by higher growth in personal consumption expenditures. The Q3 corporate earnings season is almost complete and has been showing sales growth outpacing earnings growth, leading to a reduction in profit margins, with the exception of the energy and industrial sectors. Chinese markets continued to do well on measures to ease the cash crunch for the property sector, a relaxation of some COVID-19 restrictions and the People’s Bank of China (PBoC) adding liquidity to the market. At the end of the week, government bond yields fell in the UK and Europe but not in the US. The US dollar was generally weaker with sterling rising against the euro as well; the massive correction in the dollar seen in the last fortnight seems to have been halted by the sheer number of US Federal Reserve (Fed) officials striking a hawkish tone on interest rates. It was notable that oil prices collapsed, mostly on fears of a global recession and this carried through to industrial metals too. In this environment, equities were mixed and the pound’s strength crimped returns for sterling-based investors. China and Hong Kong provided the best returns and Japan, small companies and the US the worst. The strongest sectors were defensive ones, like healthcare, consumer staples and utilities whereas the laggards were energy, technology and consumer discretionary. |

| The week ahead |

| Tuesday: UK public finances for October Thoughts: in light of the Chancellor’s austerity budget and the recent Office for Budget Responsibility (OBR) forecasts, the current state of the UK’s public finances will be informative as to how much further wiggle room the economy has. The gloomy comments from the Chancellor follow similar ones from the Bank of England’s Governor. Does this get reflected in spending and borrowing? The public sector net borrowing requirement (PSNBR) has seasonal peaks and troughs but should enlighten us on how much hard work is ahead for the Chancellor. There was a huge spurt in early 2020 due to COVID-19 support packages and since then, we have been on a higher average PSNBR than pre-COVID-19. Do we trend back down to those levels? Wednesday: manufacturing and services Purchasing Managers Indexes (PMI) Thoughts: a progressive slowdown seems to be priced into most survey expectations in various parts of the world. This week we get manufacturing PMIs and services PMIs from the UK, the eurozone, Japan and the US, which are an excellent projection of future global economic activity. Most PMIs have already fallen below the 50 thresholds between expansion and contraction but don’t look depressed yet. Japan seems to be the standout among large, developed economies, with services still in the 53 zone and manufacturing above 50. Given recently disappointing data, it will be interesting to note whether the Japanese surveys can hold on to their 50 handle. The UK and Europe seem to be heading for a recession and the readings should start to reflect that. The US is unusual in having a stronger manufacturing PMI than services. Will that continue and what is it telling us about the US economy vs. the rest of the world? Wednesday: minutes from the November Fed meeting Thoughts: the Fed provides more communication than probably all other central banks put together and yet markets gobble it up and analyse every syllable and turn of phrase. Fed Chair Powell has become quite a wordsmith as a result and the minutes of the recent meeting will be parsed to death in case they should yield any clues as to the speed of interest rate hikes and the possible pause thereafter. In light of recent comments made by various Fed officials starting to map a different direction, the minutes will take added importance. |

| Markets for the week |

| Sources: FTSE, Canaccord Genuity Wealth Management |

| Central banks/fiscal policy |

| An austere British budget portrayed as “political” and a flurry of comments from Fed officials showing incipient differences of opinion on the future of interest rates The British Chancellor Jeremy Hunt delivered his autumn statement, raising taxes, whilst increasing some benefits and support payments for some households. He forecast the UK economy to shrink by 1.4% next year and set some policy limits (underlying debt must fall as a percentage of GDP over 5 years and public sector borrowing must be below 3% of GDP). He lowered the threshold for the top 45% rate and phased down the tax-free allowance for CGT and dividend allowance, in addition to increasing the windfall tax on the energy sector. Most of it had been anticipated and hence did not move markets much. Fed Vice Chair Lael Brainard said the Fed should soon moderate the size of its interest-rate increases, signalling she favours slowing to a half-point hike as early as next month. San Francisco Fed President Mary Daly set a range for interest rates to be kept on hold afterwards. “Somewhere between 4.75 and 5.25 seems a reasonable place to think about as we go into the next meeting, and so that does put it in the line of sight that we would get to a point where we would raise and hold. Pausing is off the table right now, it’s not even part of the discussion. Right now, the discussion is, rightly, in slowing the pace.” Daly also said officials are turning their focus to how high the benchmark interest rate will ultimately need to rise to in order to be “sufficiently restrictive.” New York Fed President John Williams also stressed the necessity to defeat high inflation. “Restoring price stability is of paramount importance because it is the foundation of sustained economic and financial stability. Price stability is not an either/or, it’s a must have.” St. Louis Fed President James Bullard said that the Fed should raise interest rates to at least 5% to 5.25%. “In the past I have said 4.75%-5%. Based on this analysis today, I would say 5%-5.25%. That’s a minimum level. According to this analysis that would at least get us in the zone.” He even mentioned a 7% level. Kansas City Fed President Esther George said that she is concerned that the Fed’s tightening so far could very well cause a recession, although she wouldn’t want rate hikes “to stop too soon”. Fed Governor Christopher Waller said that he leans towards “stepping down” the pace of rate hikes. Boston Fed President Susan Collins said the Fed has more work to do: “I expect this will require additional increases in the federal funds rate, followed by a period of holding rates at a sufficiently restrictive level for some time. The latest data have not reduced my sense of what sufficiently restrictive may mean, nor my resolve.” She remains “optimistic that there is a pathway to re-establishing price stability with a labour market slowdown that entails only a modest rise in the unemployment rate.” Atlanta Fed President Raphael Bostic joined in the chorus about slowing the pace of interest rate increases. “If the economy proceeds as I expect, I believe that 75 to 100 basis points of additional tightening will be warranted. In terms of pacing, assuming the economy evolves as I expect in the coming weeks, I would be comfortable starting the move away from 75-basis-point increases at the next meeting. I do not think we should continue raising rates until the inflation level has gotten down to 2%. Because of the lag dynamics I discussed earlier, this would guarantee an overshoot and a deep recession.” The People’s Bank of China (PBoC) added liquidity to the financial system and kept the one-year medium-term lending facility rate at 2.75%, the one-year loan prime rate at 3.65% and the five-year loan prime rate at 4.30%. |

| United States |

| PPI and import prices confirm the previous week’s fall in CPI inflation. Other data are mixed, with retail sales and employment strong, housing and industry weak and surveys directionless. Inflation: the PPI fell from 8.4% to 8.0% with the PPI excl. food and energy also down from 7.1% to 6.7%. The import price index fell to 4.2% year-on-year in October from 6.0% previously, whereas the export price index dropped from 9.2% to 6.9%. Employment: jobless claims did not change much over the week, with initial claims down from 226K to 222K and continuing claims up from 1494K to 1507K. Housing: Mortgage Bankers Association (MBA) mortgage applications rose 2.7%, an improvement over the -0.1% during the prior week. The National Association of Home Builders (NAHB) housing market index fell from 38 to 33. Housing starts fell 4.2% in October, after -1.3% the prior month, with building permits down 2.4% from a positive +1.4%. Existing home sales slumped by 5.9%, from a negative 1.5% the previous month. Industry: industrial production fell 0.1% in October, from +0.1% the previous month, with manufacturing production rising only 0.1% vs. 0.2%. Capacity utilisation fell from 80.1% to 79.9%. In September business inventories rose 0.4%, down from 0.9%. Sales: retail sales were strong in October, rising 1.3% from a flat prior month, with the control group up 0.7%, from 0.6%. Surveys: the Empire Manufacturing survey (NY State) recovered from -9.1 to +4.5. The Philadelphia Fed Business outlook (‘Philly Fed’) slumped from -8.7 to -19.4. The Kansas City Fed manufacturing activity index was barely changed at -6 from -7. The Conference Board US Leading Index fell to -0.8% from -0.5%. |

| United Kingdom |

| Wages rising at the fastest pace in 20 years as inflation hits a 41-year high Employment: unemployment inched higher in September, according to the International Labour Organisation (ILO) measurement, from 3.5% to 3.6%, as the number of people in work fell by 52,000 in the quarter ending September. The number of job vacancies dropped for the fourth month to 1.23 million in the three months to October, with the claimant count rate remaining at 3.9%. There is now one job for every unemployed person. Redundancies rose 40% in Q3 to 75,000. Inflation: UK wages rose at the fastest pace in 20 years. Average weekly earnings excluding bonuses were up 5.7% year-on-year from 5.5% and above estimates, with private sector pay rising 6.6%. The CPI hit another record, with the highest rate in 41 years at 11.1%, up from 10.1% the prior month. Upstream prices were more on a downward trend, though, with the PPI easing: the PPI input fell from 20.8% to 19.2% and PPI output from 16.3% to 14.8%. All of these numbers were higher than estimates, however. Housing: the House Price Index fell sharply from 13.1% year-on-year to 9.5%. Sales: October retail sales rose 0.6% after a negative -1.5% month, with retail sales ex auto fuel also up 0.3%. Surveys: the GfK consumer confidence index recovered slightly from -47 to -44. |

| Europe |

| European data seem to be doing better than the very depressed expectations Industry: eurozone industrial production rose 0.9% in September for a 4.9% year-on-year growth, better than expected. Eurozone construction output edged up 0.1% in September, following a negative 1.0%. EU27 new car registrations rose from 9.6% to 12.2% year-on-year in October. Inflation: in Germany the wholesale price index fell from 19.9% to 17.4%. The final CPI for the eurozone was raised from 9.9% to 10.6% with the core CPI remaining at 5.0%. Surveys: the Zentrum für Europäische Wirtschaftsforschung (ZEW) survey improved, with the eurozone ZEW expectations up from -59.7 to -38.7. The German survey was also better, at -36.7 vs. -59.2 for expectations and -64.5 vs. -72.2 for the current situation. |

| China/India/Japan/Asia |

| Japanese inflation surges as China slows down China: the October economic data release was a little worse than expected, with retail sales going negative for the first time since May (at -0.5% vs. 2.5% the previous month), but other measurements are also missing estimates (industrial production at 5.0% vs. 6.3% before, fixed assets excl.-rural – i.e., investment – at 5.8% vs. 5.9% and property investment at -8.8% vs. -8.0%). The jobless rate remained at 5.5%. The housing sector is still seriously challenged, with residential property sales down 28.2% year-on-year and new home prices down 0.37% for the month. Foreign direct investment into China eased from 15.6% to 14.4% year-on-year in October. Japan: capacity utilisation in September fell 0.4%, from a positive 1.2% the prior month. Core machine orders fell 4.6% after another negative 5.8%. The tertiary industry index (i.e., services sector) fell 0.4% in September after +0.7% the previous month. Exports grew less in October, at 25.3% year-on-year vs. 28.9%. Imports, however, surged from 45.7% to 53.5%, driven by commodity imports. Inflation rose, with the national CPI up from 3.0% to 3.7% and the core reading (excl. fresh food and energy) up from 1.8% to 2.5%. |

| Oil/Commodities/Emerging Markets |

| Oil prices dropping despite supply tightness due to fears of global recession The oil producer cartel OPEC reduced its forecasts for global oil demand, whilst lowering estimates for the amount of crude it will need to pump this quarter by 520,000 barrels a day. Also, oil inventories in developed nations have sunk to the lowest since 2004, according to the International Energy Agency. Combined government and industry oil stockpiles in developed nations have fallen below four billion barrels for the first time in 18 years. Crude oil prices traded near a seven-week low on recession fears. Copper fell sharply, too, down 5%, but gold was more resilient after the recent recovery above US$1,750/oz. |

Bond Market FInance Financial News Global Markets Oil price Weekly Update