Weekly Update – 10 October 2022

| Markets last week |

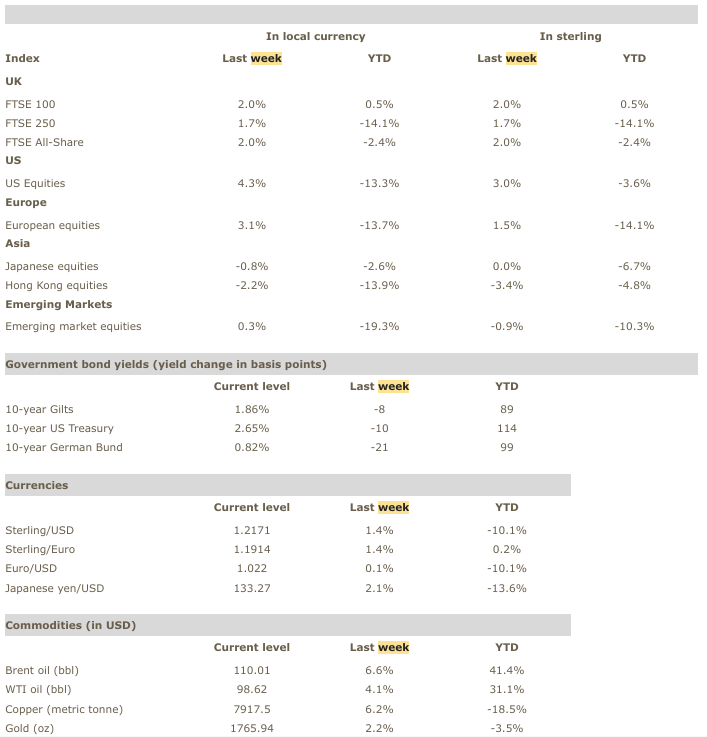

| Equities soared on Monday and Tuesday before having second thoughts again later in the week. There were a couple of triggers for the surge coming from US data. On Monday, we saw the ISM (Institute for Supply Management) manufacturing PMI falling from 52.8 to 50.9 with the employment component slumping from 54.2 to 48.7. On Tuesday, job openings dropped by one million from 11 to 10 million, a meaningful cull in that very large reading. The market rally therefore seemed to be predicated on “bad news is good news” and also “the tight jobs market is the US Federal Reserve’s (Fed) target and falling employment will solve the problem”. The markets were also probably influenced by the Reserve Bank of Australia only hiking rates by 25 bps vs. the expected 50 bps, with comments about “peak hawkishness” that seemed to resonate more widely. True, the equity market was massively oversold at the end of September and hence did not require much of a spark to be put on fire anew. The issue, though, is that Fed officials, from the Chair Jay Powell down, have been at pains to pass on the message to markets that their fight against inflation will not be interrupted until we get much closer to their 2% inflation target. It therefore looked somewhat hasty to assume that a couple of data points showing less tightness in the jobs market, would change the Fed’s policy. Similarly hawkish comments were abundantly reiterated during the week by many Fed officials. Against that backdrop, the monthly payrolls number in the US was eagerly awaited. It massively disappointed markets, even though it was very close to survey estimates. The fact that employment creation was still ¼ million new jobs rather than collapsing, shook the market despite a notable lack of statistical surprise. In addition, with a lower labour participation rate and hence fewer people entering the jobs market, unemployment and underemployment fell, exactly the opposite of what the Fed would like to see. This caused a major reversal in bond and equity markets alike on Friday. Whereas US data are showing a progressive slowdown of the economy (weaker manufacturing but resilient services, falling mortgage applications but recovering vehicle sales), Europe is in a different place, with data clearly indicating an incipient recession, as the energy cuts start to bite into business activity (factory orders and retail sales) and inflationary pressures mount (producer price indices). After the gilts and sterling crisis of the previous week, the U-turn by the Chancellor on the 45% tax rate seemed to restore order to these markets, although gilt yields still had more upward pressure than other government bonds. Yields rose during the week, by 5 bps for US treasuries and 15 bps for UK gilts. The energy sector was helped by OPEC+ announcing that they would cut two million barrels of output per day, although in practice it is expected that they will only cut by one million barrels. Nevertheless, at the end of the week, the strongest area was energy again by a long distance whereas defensive sectors (consumer staples, utilities, real estate) were the worst. Asian equities did best, in part because the biggest drop in markets came on Friday after Asian markets were closed. |

| The week ahead |

| Wednesday-Friday: various US inflation measurements (Producer Price Index (PPI), import prices, export prices) Thoughts: the market is worried about the causes of inflation and would like to figure out when the Fed will cut rates. In that respect, employment was the focus last week, but this week it’s likely to be other sources of inflation, such as the PPI and import prices. We are at the stage where investors are likely to parse inflation numbers into lots of small components to try and anticipate how each one will behave. Producer prices have been skyrocketing in Europe, although they are more anchored in the US. Once again, the difference between the headline PPI and core (excluding food and energy) will be under the headlights to gauge how far inflation is spreading. Import prices are likely to come under scrutiny due to the strong dollar. The expectation is for a negative month. Will that be realised? Thursday: US Consumer Price Index (CPI) Thoughts: ultimately, the CPI is the be-all and end-all of the inflation watch. Even though the Fed’s gauge is the core Personal Consumption Expenditures, the headline CPI is what the average person is paying, hence its importance. Also, the CPI data provides enormous levels of detail enabling analysts to ascertain how far each price category has got to go before peaking or hitting a particularly meaningful level. The assumption is that a weaker number might soften the Fed’s ardour in hiking rates. It will probably take much more than one good number, but the reaction could still be strong. Thursday: China Producer Price Index (PPI) and CPI Thoughts: China seems to be somehow forgotten in the midst of the crises seen in the UK and Europe, and US economic data driving Fed policy, but we should remember that a large percentage of industrial goods worldwide originate from China and their prices matter to the rest of us. The Chinese PPI determines a high percentage of western import prices and it has been well behaved recently. The CPI is more of a curiosity for the West: how can China get away with 1% or 2% inflation? |

| Markets for the week |

| Sources: FTSE, Canaccord Genuity Wealth Management |

| Central banks/fiscal policy |

| Fed hawkish message repeated ad nauseam There was a deluge of Fed officials reiterating the view that inflation is too high and they will not refrain from raising rates until inflation is under control, irrespective of the volatility in markets: Governors Christopher Waller and Lisa Cook, San Francisco Fed President Mary Daly, Atlanta Fed President Raphael Bostic, Cleveland Fed President Loretta Mester, Minneapolis Fed President Neel Kashkari, Chicago Fed President Charles Evans and New York Fed President John Williams, all repeated the same hawkish message. In the UK, following backlash on the Chancellor’s tax cut package, the removal of the 45% tax rate was scrapped, which seemed to go some way toward calming the gilt market and sterling. |

| United States |

| Really mixed data with strong numbers for services and jobs, and weak housing and manufacturing readings Surveys: the Institute of Supply Management (ISM) manufacturing Purchasing Managers Index (PMI) dropped to 50.9 from 52.8, with the underlying components showing a significant slowdown: new orders fell to 47.1 from 51.3, employment to 48.7 from 54.2 and prices paid to 51.7 from 52.5. Conversely, the ISM services index remained very strong at 56.7 from 56.9. Industry: total vehicle sales, as recorded by Wards, recovered from 13.18 million (annualised rate) to 13.49 million. Factory orders were flat in August, but ex transportation went up 0.2%. Employment: in the job openings and labour turnover survey (JOLTS), job openings registered one of their biggest falls, from 11.17 million to 10.05 million. The job cuts, as reported by Challenger, rose by 67.6% year-on-year in September, up from 30.3% (i.e., more job cuts). The weekly jobless claims bounced back after a few months down, with the initial claims up from 190K to 219K and the continuing claims up from 1346K to 1361K. The monthly non-farm payrolls were lower than the previous month, at 263K new jobs vs. 315K, with only a small number (22K) coming from manufacturing. Due to the lower labour force participation rate, at 62.3% vs. 62.4%, the unemployment rate (U-3) fell from 3.7% to 3.5% and the underemployment rate (U-6) from 7.0% to 6.7%. Average hourly earnings were unchanged from the previous month at 0.3% for September but lower on a year-on-year basis, at 5.0% vs. 5.2%. Housing: with mortgage rates hitting the highest levels in 16 years, MBA mortgage applications fell heavily, down 14.2%, from -3.7% the previous week. Trade: the trade balanced improved marginally, from US$70.5bn to US$67.4bn. |

| United Kingdom |

| Few meaningful statistics Industry: new car registrations in September improved, with the year-on-growth now up to 4.6%, from 1.2% the prior month. Surveys: the S&P Global/CIPS Construction PMI recovered from 49.2 to 52.3. Housing: the cost of a 5-year fixed mortgage loan exceeded 6% for the first time in more than a decade. |

| Europe |

| Soaring prices and slumping growth Inflation: the eurozone PPI (producer price index) surged further from 38.0% to 43.3%. Germany’s import price inflation rose to 32.7% in August, driven by energy products. Sales: retail sales in the eurozone fell again, down 0.3% in August, after -0.4% for a -2.0% year-on-year downturn. Industry: German factory orders dropped 2.4% in August adding up to 4.1% year-on-year. On the other hand, French industrial production rose 2.4% in August for a 1.2% year-on-year growth. German industrial production, however, fell 0.8%, for a +2.1% year-on-year growth. Surveys: the S&P Global construction PMI for Germany fell further from 42.6 to 41.8. |

| China/India/Japan/Asia |

| Japanese data are going against the global slowing trend whilst Chinese services are slumping China: foreign exchange reserves eased from US$3.055trn to US$3.03trn. The unofficial Caixin services PMI slumped from 55.0 to 49.3. Japan: vehicle sales in September soared 17.8% after a heavily negative month. The monetary base fell 3.3% year-on-year in September, down from +0.4%. August household spending surged to 5.1% year-on-year, from 3.4% previously, as labour cash earnings rose 1.7%, up from 1.3%. The Leading Composite Index (CI) increased from 98.9 to 100.9 and the Coincident Index from 100.1 to 101.7. |

| Oil/Commodities/Emerging Markets |

| OPEC + boosting oil prices The crude oil price was helped by OPEC+ saying they would slash output by two million bbls/day, but in practice, the market expects them to cut only by one million bbls. Gold’s rally was clipped by the payroll data. The earlier move up during the week seemed to be based on the expectation of a change in policy by the Fed due to softer employment numbers. At the end of the week, Brent oil surged by 11%, the US crude gauge WTI by more than 16%, copper fell 1.4%, reflecting the weaker global economy. Finally, gold edged up 2%. |