Weekly Update – 17 October 2022

| Markets last week |

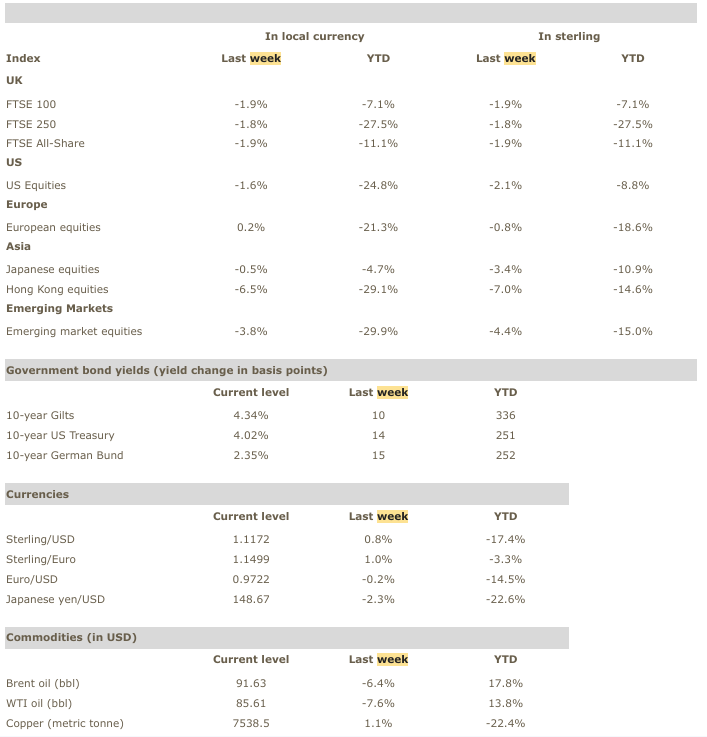

| Markets were in thrall to inflation data and central bank action last week, with political developments in the UK throwing some spice on an already volatile backdrop. US consumer prices spooked investors, particularly with an increase in core inflation. This number abruptly halted a risk rally in both bonds and equities. Simultaneously, however, the UK market reacted to rumours of a U-turn in the recent budget and ultimately to the change in Chancellor and reversal on certain tax cuts. This was seen as positive for British assets and created the unusual situation of US bond yields rising and UK yields falling. The Bank of England’s (BoE) asset purchases were responsible for a better mood not just in gilts but also in the value of sterling. Markets caught a further bid on Friday with the Chancellor’s resignation followed by the appointment of Jeremy Hunt and the third quarter (Q3) earnings report (for US banks) looking very positive. The change of mood did not last very long, though, as gilt yields resumed their upward climb after the BoE ceased buying on Friday afternoon and US equities fell heavily from their Thursday surge. Different markets provided different discourses, though. The Thursday equity rally took place as US treasury bonds were busy announcing a possible recession through a sharp inversion of the yield curve between 2 years and 10 years (2-year yield higher than 10-year yield). The difference in yield between the 2-year note and 10-year bond rose to above 50 bps late in the week but finished slightly below 50 bps. Markets are now expecting the US Federal Reserve (Fed) to hike rates by 75 bps on 2 November, 50 bps in December and 25 bps in early February, although an admittedly hawkish Fed official James Bullard hinted on Friday at a higher December increase. At the end of the week, government bond yields rose sharply again, with US bond yields up 14 bps and gilts a little less, up 10 bps, mostly due to Friday’s political announcement. Commodities were mixed, with oil dropping more than 6%, but copper and other metals slightly higher. Gold also corrected by 3% in US dollar terms. The US dollar took some profits against European currencies, but the Japanese yen continued to lag. Sterling was fairly stable vs. the euro. Equities had a tough week despite the Thursday rally, with Asian markets being hit the most. European equities managed to outperform, but mostly because US equities fell sharply on Friday afternoon when Europe was closed. Technology was the worst sector, followed by real estate, utilities and energy, but healthcare and consumer staples eked out a gain over the week. |

| The week ahead |

| Monday-Thursday: Empire Manufacturing and ‘Philly Fed’ Thoughts: economic growth should be abating in the US, if monetary policy is at all successful. So far, the US has slowed down only very gradually, in contrast with steeper drops in Europe and the UK. Surveys tend to anticipate economic movements and the two coming this week (the Empire Manufacturing Survey, i.e. New York State, and the Philadelphia Fed Business Outlook Survey, known as the ‘Philly Fed’) are generally paired together, as a bellwether to the monthly manufacturing Purchasing Managers Index (PMI) which is the more official forecast of economic growth in the US. No major upsets are expected, but the details can help understand how inflation could be behaving in the next few months. Tuesday: ZEW survey in the eurozone and Germany Thoughts: the ZEW (Zentrum für Europäische Wirtschasftsforschung) surveys originated in Germany but now cover the whole of the eurozone as well. The expectations part of the survey is the most widely followed number, being determined by 350 financial market experts. The latest number was close to the all-time lows in 2008, likewise for the German expectations survey which is also challenging all-time lows. Does it have further to go down in forecasting the dire straits in which the European economy will find itself this winter coping without Russian natural gas, or is it all in the market already? Wednesday: UK September CPI, RPI and PPI Thoughts: has British Government policy so spooked markets that inflation becomes an unfathomable number? It wasn’t that long ago that the Governor of the Bank of England was forecasting double-digit inflation, but then the government decided to cap the energy spend for households. Will that step increase or decrease inflation? The answer is not 100% clear for markets. Would a lower headline CPI (consumer price index) be accompanied by a higher core CPI, as energy costs are capped but the higher prices spread to the rest of the economy, as is the case in the US? The differential between core and headline CPI will be relevant to markets, as will the PPI (producer price index) readings, both the PPI output (factory gate prices) and PPI input (raw and intermediate inputs entering the production process). |

| Markets for the week |

| Sources: FTSE, Canaccord Genuity Wealth Management |

| Central banks/fiscal policy |

| No expected change from Fed and ECB catching up with Fed Loretta Mester, Cleveland Fed President, provided a long interview about Fed policy but did not change any views. Although she couldn’t be drawn into stating how much she would vote to increase rates next month, she made it very clear that the Fed was not going to change its policy about raising rates and not cutting them shortly afterwards. James Bullard, St Louis Fed President (a notable hawk), however, strayed a little from the well-worn communications path and hinted at a possible bigger hike in December, breaking the market consensus of 75 bps next month, 50 bps in December and 25 bps in early February. European Central Bank (ECB) Governing Council member Pierre Wunsch said interest rates may eventually have to top 3% to get record inflation under control. “My bet would be it’s going to be over 2%, and I would not be surprised if we have to go to above 3% at some point”. The ECB’s deposit rate, currently 0.75%, will “most probably” need to exceed 2% year-end. “We’ve been claiming that what happens in Europe is different from the UK, from the US. But over the last six months basically the direction we’ve been taking was not that different”. He hinted that the ECB would have to go to “real positive” interest rates and that a “technical recession” in the eurozone was likely. The People’s Bank of China left the 1-year medium-term lending facility rate unchanged at 2.75%. |

| United States |

| Core inflation at 40-year high Surveys: the National Federation of Independent Business (NFIB) small business optimism survey unexpectedly rose from 91.8 to 92.1. The University of Michigan sentiment index beat expectations with a rise to 59.8 from 58.6, current conditions surging from 59.7 to 65.3, but expectations falling from 58.0 to 56.2. Retail sales: retail sales were flat in September versus up 0.4% the previous month and rose 0.4% ex auto and gasoline, up from 0.2%. Inventories: business inventories increased 0.8% in August, up from 0.5% previously. Inflation: Producer prices rose in September by 0.4% for both headline and core PPI (from 8.7% to 8.5% year-on-year for the headline PPI and unchanged at 7.2% for the core PPI), a disappointment after two months of falling PPI and an apparent halt to the year-on-year PPI fall since March. The CPI surprised on the upside, with the headline number at 8.2%, down from 8.3% previously but the core reading up from 6.3% to 6.6% (the highest level since August 1982), indicating that inflation is spreading throughout the economy from energy and goods in general to services, rents and wages. Indeed 3.9% of the 8.2% CPI was made up of services inflation. The real average hourly earning fell from -2.8% to -3.0% as inflation rose. Import prices in September fell 1.2% for a year-on-year increase of 6.0% down from 7.8%, with the import price index ex petroleum down 0.5% on the month. The export price index fell 0.8% for a year-on-year increase of 9.5%, down from 10.7%. The University of Michigan inflation expectations for one year surged from 4.7% to 5.1% and for 5-10 years from 2.7% to 2.9%. Employment: jobless claims rose, with initial claims up from 219K to 228K and continuing claims from 1365K to 1368K. Some of the weekly increase, though, may have been distorted by Hurricane Ian. Housing: Mortgage Bankers Association (MBA) mortgage applications fell 2%, after the previous week when they collapsed 14.2%. |

| United Kingdom |

| Disappointing growth but strong employment Retail sales: the British Retail Consortium (BRC) sales like-for-like rose from 0.5% to 1.8% year-on-year in September. Housing: the Royal Institute of Chartered Surveyors (RICS) house price balance in the UK collapsed from 51% to 32%. The cost of a 5-year mortgage fell for the first time in a fortnight, to an average of 6.28% with the average 2-year fixed rate loan at 6.46%. The Rightmove house prices for October rose 0.9% for a year-on-year increase of 7.8% down from 8.67% previously. Employment: unemployment was again very low and hit levels not seen since the early 1970’s. The International Labour Organisation (ILO) unemployment rate over the last three months fell from 3.6% to 3.5% in August, whereas the claimant count rate in September remained at 3.9%. Average weekly earnings for the last three months year-on-year rose from 5.5% to 6.0% in August, but a smaller increase from 5.2% to 5.4% ex bonus. Growth: the August GDP growth disappointed, down 0.3% after a slightly positive 0.1% month. The breakdown shows construction output up 0.4%, industrial production down 1.8%, including manufacturing production down 1.6%, the index of services fell 0.1% and the trade deficit increased. |

| Europe |

| Weak surveys and rising pipeline inflation Surveys: the Sentix investor confidence for the eurozone fell from -31.8 to -38.3, the worst over the last 10 years other than the COVID-19 low. Industry: industrial production in the eurozone in August rose 1.5%, up from a -2.3% month. Inflation: the German wholesale price index rose 1.6% in September for a year-on-year growth of 19.9% from 18.9%. |

| China/India/Japan/Asia |

| Mixed data in Asia, with exported inflation lower in China but higher in Japan China: money supply was fairly stable, with M0 at 13.6% year-on-year, from 14.3%, M1 at 6.4% vs. 6.1% and M2 at 12.1% vs. 12.2%. The PPI was slashed from 2.3% to 0.9% whilst the CPI increased from 2.5% to 2.8%. Japan: the PPI surged to 9.7%. from 9.0%. September machine tool orders fell from 10.7% year-on-year to 4.3%. Core machine orders, which are much more domestic, fell 5.8% in August from a positive 5.3% the previous month. The Eco Watchers Surveys were resilient, with the current reading up from 45.5 to 48.4 and the outlook down from 49.4 to 49.2. Money supply was steady, with the money stock M2 easing from 3.4% to 3.3% year-on-year and the money stock M3 from 3.0% to 2.9%. |

| Oil/Commodities/Emerging Markets |

| After the massive rally due to the Organisation of the Petroleum Exporting Countries (OPEC) output cut announcement, oil prices settled at a lower level based on expectations of a global slowdown, which also affected other commodities. The relentless strength of the US dollar has taken its toll on US dollar-denominated global assets like raw industrial metals and energy. The high US CPI on Thursday trimmed an incipient rally in gold prices, as bond yields surged again. |