Weekly Update – 31 October 2022

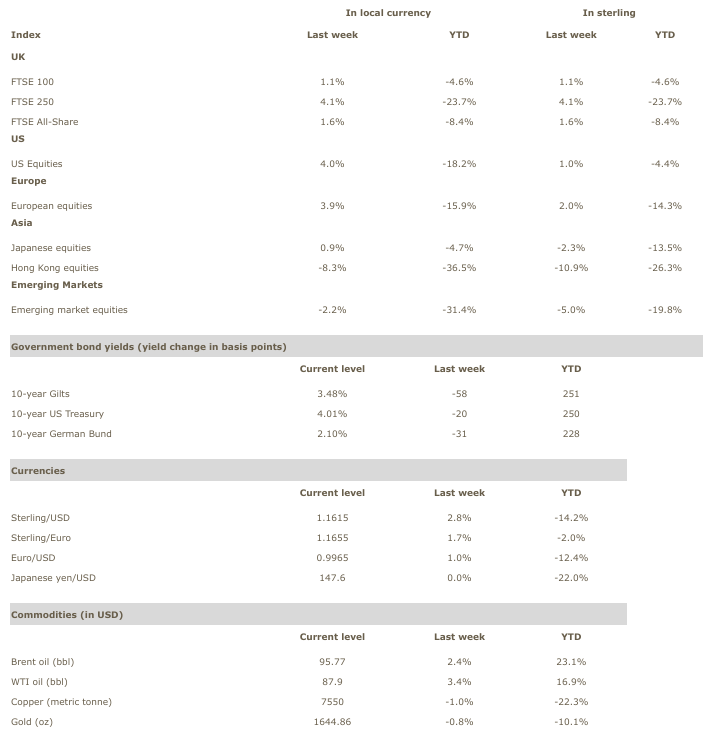

| Markets last week |

| Despite headline news moving risk appetite in different directions, equities eked out a fourth weekly gain. Earnings disappointment started early during the week but picked up steam on Thursday and Friday with US tech companies missing estimates, cutting future guidance and in particular social media collapsing. Manufacturing and services surveys clearly showed a recession ahead for the UK, Europe and increasingly for the US, with Japan as the only beacon of stability in the developed world. Nearby, however, Chinese markets are still reeling from the aftermath of the Communist Party Congress, which was seen as unequivocally negative for Far Eastern investors. Back home, the UK seems to be emerging from a period of troubles and going back into a boring routine, to the delight of British markets. All of that against the backdrop of untamed inflation that seems to be spreading, but with somehow glimmers of hope in the US that the worst might be over. About 40% of companies have reported their Q3 earnings so far in the US and Europe, with earnings growth still beating estimates as per usual, but by much less than in previous quarters. Earnings growth is down 3% in the US and up 5% in Europe (the difference mostly due to the strong US dollar – indeed, Japanese earnings are up more than 20% thanks to the plummeting yen). There also seems to be an increasing difference between high inflation-fed revenue growth and the more challenged earnings progression. Although corporate earnings were mixed, the companies that did well tended to be ‘old economy’ businesses, whereas the losers lay predominantly in the technology sector, including media and consumer discretionary. Thursday and Friday saw a tech rout with Meta, Google, Microsoft and Amazon slumping. Nearly US$800bn was wiped off the market value of megacap companies in the US. Better news from Apple helped markets recover strongly on Friday. Together with the meltdown in tech, the US dollar corrected. British markets enjoyed much needed stability following Rishi Sunak’s accession to No.10. Gilt yields dropped sharply (now at 3.48% for 10 years after peaking at 4.50%). They are still much higher than pre-Liz Truss, but in line with the general increase in developed country government bond yields over the past month. Sterling recovered almost half of its drop against the euro. Whether there is still some fragility ahead is unclear, but the government’s announcements helped pacify nervous markets. The Bank of Canada dialled back the pace of hikes amid recession fears, after a similar move by the Reserve Bank of Australia, despite recent inflation concerns. The European Central Bank (ECB), however, stuck to the expected 75 bp hike but watered down its language for future rate rises. This week’s meeting of the US Federal Reserve (Fed) is eagerly awaited for Chair Powell’s comments on future policy more than the expected rate rise. Post the ECB meeting, eurozone government bond yields surged by an average of 15 bps, but still ended the week down 30 bps. 10-year US treasury yields also fell 20 bps but the star was UK gilts. Gilt prices surged on the political change and yields fell a whopping 58 bps. The US dollar was weaker across the board and sterling led currency markets, up 2.8% on the dollar but also 1.7% on the euro. Oil prices rose 2-3% but industrial metals were mixed. In equities, there was a huge discrepancy between the best market (UK small caps) and the worst market (Chinese shares) with the FTSE 250 up 4% against Hong Kong down 11%. The best sectors were a mix of generally value sectors, with utilities, industrials, financials and consumer staples leading, whereas the worst sector was communication services, which is mostly driven by the big megacap names that suffered badly last week. |

| The week ahead |

| Tuesday: JOLTS job openings in the US Thoughts: better than the ISM (Institute for Supply Management) manufacturing PMI (purchasing managers’ index), even the services PMI or factory orders, at this stage job openings will drive markets. It is no secret that there are four million more job openings than jobseekers and that this is a major factor in keeping inflation sticky (especially in services) and driving monetary policy. Will we get a break from the job opening surfeit so that the Fed can stop raising rates fast and might even consider cutting them at some point in the not-too-distant future? These are the high stakes behind the JOLTS (Job Openings and Labour Turnover Survey) tomorrow. A small dip is expected, but it would take a significant slump to move the Fed, which has clearly signalled its desire to get rid of extra job openings rather than creating unemployment, a feat that most economists equate with tight-rope walking. Wednesday: FOMC (Federal Open Market Committee of the US Federal Reserve) meeting Thoughts: another Fed meeting, another 75 bp rate hike. Until not that long ago, the noises among Fed officials were even more hawkish and flagged up an outside chance of 100 bps. Recently, the rhetoric has calmed down and, if anything, some pause in rate increases might be expected. To be fair, 75 bps appears baked in the cake for Wednesday, but it’s the language that will matter. Guidance for future meetings is crucial to markets. How much more in December and early February? How high will they go? When will they stop? And for how long? Once again, every syllable of every word will be dissected by investors, hoping to snatch a bit of optimism from the current gloomy market discourse. Friday: US non-farm payrolls Thoughts: like the JOLTS, non-farm payrolls have the potential to move markets, almost for the same reason. If the US keeps creating a quarter of a million new jobs every month, the Fed’s inflation fight will be much harder than if new jobs dwindle. The added jobs over the last months were overwhelmingly in the services sector, with healthcare, education and hospitality at the top. Hard to see those sectors turning off suddenly, but the direction and speed could make a difference. Also, the elephant in the room is the labour force participation rate. Millions of people have given up on employment altogether, due to long COVID-19, opioid addiction, early retirement, going back into education, etc. Will any of them come back into the work force? Last, but not least, are average hourly earnings finally on a downward path rather than a tear? These questions matter more than the raw unemployment rate (U-3) or the underemployment rate (U-6). |

| Markets for the week |

| Sources: FTSE, Canaccord Genuity Wealth Management |

| Central banks/fiscal policy |

| The ECB is signalling a flattening of the rate hike slope. Japan is in a world of its own. The European Central Bank (ECB) raised its rates by 0.75%, as expected, bringing the main refinancing rate to 2.0%, the marginal lending facility to 2.25% and the deposit facility rate to 1.5%. They put the reduction of their €8.8trn balance sheet on the agenda, by cutting a key subsidy to banks, forcing them to repay trillions of euros of loans back. ECB President Christine Lagarde said over several meetings that there are still further rate increases in the future, but rates might not go as high as previously thought. ‘Our sense is that we have already made significant progress, as I said. We are not done yet. There is more ground to cover, and the question of what that pace will be, what will be the magnitude of future rates, will be determined meeting by meeting and will be data dependent.’ Despite the early interpretation of these comments as dovish for rates, a few ECB officials spoke up the next day to clarify the meaning as hawkish, which had an impact on eurozone government bonds on Friday. The Bank of Japan (BoJ) left its rates unchanged at -0.10%, the only negative rates left in the world today. The BoJ raised its inflation forecasts to 2.9% from 2.3% for the current year, to 1.6% from 1.4% for next year and to 1.6% vs. 1.3% for the following year, with GDP growth forecasts being taken down for this year and next. |

| United States |

| Markedly weaker surveys and inflation missing high expectations point to the slowdown broadening from just the housing market. Sticky employment, income and spending will make the Fed’s job harder, though. Surveys: the S&P Global manufacturing PMI just slipped below 50, at 49.9 from 52.0 and services slumped from 49.3 to 46.6. The Conference Board consumer confidence index fell to 102.5 from 107.8, mostly driven by current conditions rather than expectations. The Richmond Fed manufacturing index dropped from 0 to -10 and the Kansas City Fed manufacturing activity index fell from +1 to -7. Inflation: the employment cost index for Q3 eased to 1.2% from 1.3% in Q2. In September the PCE deflator (personal consumption expenditures) stayed at 6.2% with the PCE core deflator (ex energy and food) rising from 4.9% to 5.1%, albeit both numbers being 0.1% below expectations. Money supply: M2 money supply declined -0.6% in September. Housing: the Case-Shiller home-price growth index slowed the most on record (from 15.62% year-on-year to 12.99%) as high borrowing costs sapped demand. New home sales fell in September by 10.9% following a gain in August. Mortgage rates rose to 7.16% during the week, the highest level since 2001, and MBA mortgage applications fell 1.7% after -4.5% the previous week. Pending home sales in September collapsed 10.2%, down from -2.0% the prior month, for a year-on-year drop of 30.4%. Inventories: retail inventories rose 0.4% in September, down from 1.4% the previous month and wholesale inventories were down to 0.8% from 1.4%. Growth: Q3 GDP exceeded expectations at 2.6% (annualised), up from -0.6% in Q2. The GDP price index dropped quite sharply from 9.0% to 4.1%, below estimates. Personal income grew 0.4% in September, as in the prior month, and personal spending at 0.6%, also stable. Industry: September durable goods orders were up 0.4%, but ex transportation fell 0.5% with capital goods non-defence ex aircraft down 0.7%. Employment: there are incipient signs of cooling in the job market, with the share of consumers who said jobs were plentiful falling to 45.2%, the lowest since April 2021 and the share who said jobs are hard to get rising to the highest share since September 2021. The labour differential therefore fell from 38.1 to 32.5, the lowest reading in 18 months. Jobless claims continued to show a resilient employment sector, however, with initial claims up slightly from 214K to 217K whereas continuing claims were up more from 1383K to 1438K. |

| United Kingdom |

| Generally weaker surveys point to a potential recession Surveys: the manufacturing PMI dropped from 48.4 to 45.8 while the services PMI fell from 50.0 to 47.5. The CBI (Confederation of British Industry) trends survey was worse with total orders falling from -2 to -4 and business optimism collapsing from -21 to -48, whereas selling prices were lower at 46 vs. 59. In addition, the CBI distribution survey showed total distribution reported sales rising from -26 to 0 and retailing reported sales from -20 to +18. The Lloyds Business Barometer eased from 16 to 15. |

| Europe |

| Depressed surveys may actually have hit a low Surveys: the eurozone manufacturing PMI fell from 48.4 to 46.6 but services were more resilient at 48.2 vs. 48.8. Eurozone confidence was weaker, with economic confidence down from 93.6 to 92.5, industrial confidence down from -0.3 to -1.2 and services confidence down from 4.4 to 1.8. The widely followed German IFO business confidence remained at a depressed level but was better than expected for business climate (84.3 vs. 84.4), current assessment (94.1 vs. 94.5) and expectations (75.6 vs. 75.3). The German GfK consumer confidence index slightly edged up from -42.8 to -41.9 and French consumer confidence climbed from 79 to 82. Money supply: the eurozone money supply for September rose from 6.1% year-on-year to 6.3%. Consumer: French consumer spending rose 1.2% in September, up from 0.1% the prior month. Retail sales in Germany rose 0.9% in September, up from -1.4% the prior month. Inflation: German inflation beat estimates, rising to 11.6% for the EU harmonised CPI (consumer price index) from 10.9%. |

| China/India/Japan/Asia |

| China slowing down whilst Japan is holding on China: industrial profits fell 2.3% year-on-year in September, down from -2.1% previously. Foreign direct investment into China was up 15.6% year-on-year in September, down from 16.4%. The official China Federation of Logistics and Purchasing (CFLP) manufacturing PMI fell to 49.2 from 50.1 and the non-manufacturing PMI to 48.7 from 50.6, both below estimates. Japan: the Jibun Bank manufacturing PMI was solid at 50.7 and services were higher at 53.0. The PPI (producer price index) for services was a little higher at 2.1% vs. 2.0%. The jobless rate edged up from 2.5% to 2.6% in September. The consumer confidence index fell from 30.8 to 29.9. Housing starts slowed down to 1% year on year in September, from 4.6% previously. |

| Oil/Commodities/Emerging Markets |

| Higher oil prices stand out among commodities The Ukraine war came off the headlines, but oil prices continued to drift higher even as gas prices were collapsing in both Europe and the US, reflecting mostly supply cuts. Brent oil was up 2.4% and the US gauge, WTI, was 3.4% higher. Industrial metals were mixed and gold was a little lower after attempting a rally during the week. |

Bond Market FInance Financial News Global Markets Markets Oil price